Mileage Tracker by Driversnote app for iPhone and iPad

Developer: Driversnote ApS

First release : 18 Nov 2014

App size: 59.43 Mb

Say goodbye to tedious paper mileage logs with the most accurate automatic mileage tracker.

Accurately track business mileage and create IRS-compliant logs at the touch of a button.

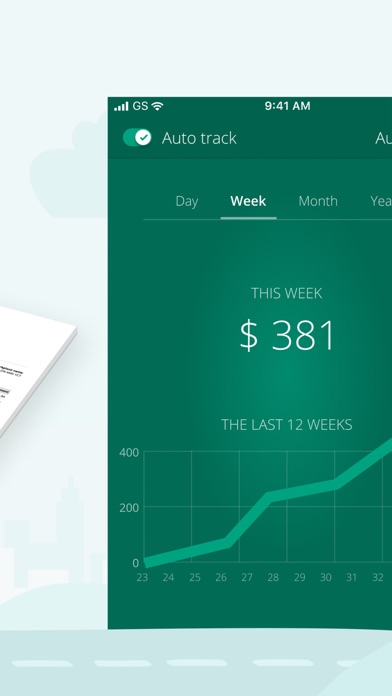

With Driversnote, you get all the reimbursement or deductions you’re entitled to. Join over 1,7 million drivers and simplify miles tracking to just 3 steps: Track, Classify and Report!

◉ CLAIM YOUR TIME BACK

Our mile tracker saves you hours of manually logging journeys. The app records all the information you need in real time.

◉ TAX TIME ISN’T A HEADACHE ANYMORE

Effortlessly get tax-compliant mileage logs of your work-related driving for reporting to the IRS.

◉ BE THE MOST ORGANIZED EMPLOYEE

Create and send your trip logs to your employer in a matter of seconds.

◉ TAX AUDIT COMING UP?

Access your previous and current logs anytime, anywhere.

◉ WORLD-CLASS SUPPORT

Simply send an email to our brilliant Support team with any questions and they’ll get back to you.

The only mileage tracker you need as a business, sole trader, employee, employer, or just about anyone who drives!

► 1. TRACK

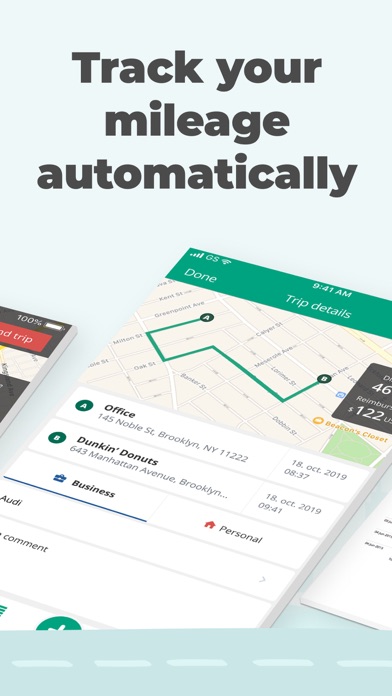

※ Track trips completely automatically - the car mile tracker will start tracking once you reach a certain speed.

※ Want to track an individual trip? Just tap START and STOP and leave the rest to our smart GPS automatic mile tracker.

※ Effortless odometer tracking.

※ Forgot to track travel during the day? Enter the start and end addresses of your drives and the app will do the rest for you.

► IBEACON: Further Improve Automatic Miles Tracking

Place an iBeacon in your car and Driversnote will track only your preferred vehicles miles every time you enter or leave your car. Get a free iBeacon when you sign up for the annual Basic subscription.

► 2. CLASSIFY

※ Categorize each trip as Business, Personal, Medical or Charity for a compliant driving log

※ Set your working hours for automatic classification of trips as Business and Personal

※ Add notes to your recorded journeys

※ Review your trips at a glance and easily edit details

► 3. REPORT

※ IRS-compliant reports for your employee reimbursement or car expenses tax claim

※ Claiming deductions by the actual expenses method? Use the percentage split to report the percentage of miles you traveled for work

※ Create separate logs for separate vehicles and workplaces

※ Choose if you want to show odometer readings

※ Have your reports include the total miles, start and end dates, distance, reimbursement amount or % split between business and personal driving

※ Get your vehicle log books in PDF or Excel, or send them directly through the app

► DRIVERSNOTE FOR WEB: Bring All the Functionality to Your Desktop

※ Review your logs and edit details easily

※ Add trips you forgot to record

※ Generate your mileage reports

► KEEP ON TOP OF YOUR LOGBOOK

※ Customize your reimbursement rate if it’s different from the one the IRS sets

※ Set reporting reminders so you never forget to report your miles

※ Save addresses you visit often

► DRIVERSNOTE FOR TEAMS: Perfect for Business Reimbursement Programs

※ Invite and remove users

※ Employees use the automatic mileage tracker

※ Employees create & share consistent logbooks with their managers

※ Managers review and approve reimbursement expense claims in one simple overview

※ Privacy - managers can only see the trips employees report

► PRIVACY BY DESIGN

※ We never sell data

※ We will never provide your information to other parties for marketing purposes

※ See more in our Privacy Policy

► SUPPORT

※ Looking for a quick answer to your question? Visit our comprehensive Help Center straight from the app.

※ Our efficient and effective Support team is ready to assist you at any time at [email protected]